Chancellor of the Exchequer Philip Hammond announced £2bn investment in mental health services,an extra £500m for preparations for leaving the EU, and £1bn extra to the Ministry of Defence in his 2018 budget today.

The Chancellor, who addressed himself as ‘Fiscal Phil’ during the speech, was as safe as expected, having previously gained the nickname ‘Spreadsheet Phil’.

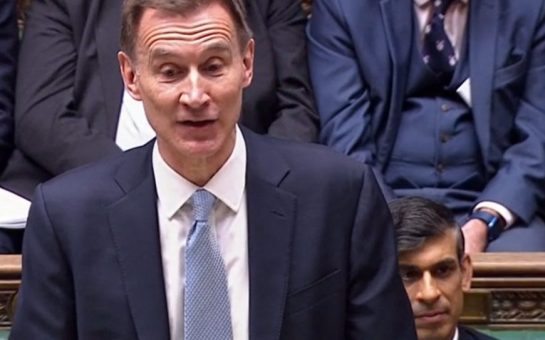

Budget 2018 (by Harry Benbow)

This budget is a special one, marking the last UK budget before Brexit, and being shifted a month forwards as not to interfere with the negotiations. It also marks the first time since 1962 that a budget has been announced on a Monday, normally being held on a Wednesday.

Last time this happened the then Chancellor Selwyn Lloyd increased tax on sweets and ice cream and was accused of taxing children’s pocket money, before his sacking a few months later.

If it was to be announced on Wednesday it would clash with Halloween, making for easy headline jibes, such as ‘Hammo House of Horrors’ which Philip himself recommended during his parliamentary address, although the government insist that this had nothing to do with the decision.

Technology (by Matthew D’Henin)

Last year, the Chancellor’s 2017 budget committed over a billion pounds to new, hi-tech developments such as driverless cars and artificial intelligence. Half of the £1billion was invested in electric car charging stations and £100m was pumped into boosting clean car sales.

A year later, the Chancellor declared that with Brexit looming it is time to ‘‘unleash the investment that drives future prosperity’’, hinting early on in his announcement that a substantial technological investment could be granted, building upon that in 2017.

This wasn’t the case. Hammond announced no further investments into driverless cars or developing a 5G Network.

It was widely expected that he would announce a huge outlay on advancing broadband in rural areas. This wasn’t the case either.

The largest of the Chancellor’s digital announcements during the Budget reveal was a UK Digital Services Tax, earmarked to come into play from April 2020. Larger online retailers with an annual revenue of over £500million will be responsible for £400million per year of new, national income according to the Chancellor.

He insisted it would be ‘narrowly targeted’ and only for established tech giants, not smaller startups.

It is already alarming that this year’s technological investments into research and development are miniscule compared to last year. In his budget speech on Monday, the Chancellor said we must “send a message to the world that Britain is open for business.”

More realistically, as far as technology is concerned, the lack of financial encouragement towards technological advancement is worrying.

The high street (by Anna Brocklehurst)

A £1.5 billion boost was announced for UK high streets in the budget. This will be done through business rates being cut by a third for almost half a million small retailers. The plan will include a £900 million of immediate business rates relief.

Also, a £650 million fund will be announced to improve infrastructure and transport. Empty shops are set to be re-developed as homes and offices, with old properties being restored and re-used.

According to the Treasury, the changes mean a pub in Sheffield with a rateable value of £37,750 will save £6,178 next year.

This boost comes after Debenhams is the latest retailer to announce closures, stating 50 shops and 4,000 jobs are at risk, after a near £500 million loss.

A review of marriage laws will see more hotels, pubs and restaurants hold weddings. The rules dating back to 1836 will be simplified, even allowing couples to get married in the open air.

Transport (by Jordan Baker)

The UK is to get an extra £420m to try and tackle the growing number of potholes.

Earlier this year drivers breaking down as a result of hitting potholes reached a three-year high, according to the RAC.

Councils will also be given an extra £150m in order to improve road junctions on local roads.

The Chancellor also announced a 30% growth in infrastructure spending.

Many in the North were hoping for more expenditure on transport, as over the last decade Londoners have had an average of £708 per head spent on transport per year, whereas £289 was spent in the North.

The North has lost out on £63bn in transport investment because of this. It has been estimated it would cost £69bn for the North to bring its transportation systems up to scratch with the South.

Environment (by Mariam Ahmed)

The 2018 budget will also be affecting the money spent on preserving the environment, one of them being plastic tax.

Hammond announced a new tax on non-recycled plastic packaging, however didn’t declare a tax on takeaway coffee cups, instead saying that one will be reconsidered if the industry doesn’t progress.

As well as this, he announced a £60 million pledge to plant more trees. Although this incentive does encourage the preservation of the countries environment, many are outraged that this is just a fraction of the £30bn that is being spent on the roads.

Liz Hutchins, Friends of the Earth campaign director, said: “We need to double the UK’s forest cover if we’re going to avoid climate breakdown, and this won’t be nearly enough money.”

Health (by Emily Brignall-Morley)

Theresa May pledged an extra £30bn to the NHS, which Hammond today confirmed.

There will be a £20.5bn boost for the NHS over the next five years, and mental health funding is to increase by £2bn by 2023-24.

This is in an effort to bring mental health services up to par with physical health services, at the time of a mental health crisis.

It is said that 1 in 4 people will experience mental health struggles in their lifetime, and last year there were 5,821 suicides in the UK. 75% of these were males.

Health and social care secretary Matt Hancock said the budget, which will take years to achieve, is still “way off where we need to be.”

Apparently, the NHS money will not be impacted by a No Deal Brexit, so the money for healthcare will come no matter what.

There will be more help to give adults with mental health issues the opportunity to gain employment, specialist care teams introduced in schools and mental health support available 24/7 in large A&E departments.

Another promise is ‘mental health ambulances’, which are normal-looking cars used to treat people with mental illnesses such as depression, anxiety or PTSD.

Other

On a far merrier note, beer, cider and spirits duties are to be frozen!

The personal allowance threshold is also to rise from £11,850 to £12,500 in April. This is the rate at which you begin to pay income tax, and the change comes a year earlier than planned.

National Living Wage is also set to increase 4.9%, from £7.83 to £8.21 an hour, from April 2019.

There will also be a one-off £400m investment to help schools buy “the little extras they need.”

Budget nightmares

The budget doesn’t always run smoothly, with some major mishaps in the past.

The previous Chancellor George Osborne had to make major changes to his 2012 Budget proposal, including to what was dubbed the ‘Pasty Tax’.

He proposed a 20% VAT on most hot food, closing the loophole that excluded pasties and pies from this tax.

This was seen as an attack on the working man’s lunch, with both Osborne and then Prime Minister David Cameron blundering over the last time they’d eaten a pasty.

Eventually the tax was overturned, but not before The Sun headline “LET THEM EAT COLD PIES”, in response to the Chancellor’s claim that by buying cold pies you could dodge the tax.

Former Liberal Democrat MP and chief secretary to the Treasury Danny Alexander delivered an ‘alternative budget’ in 2015, where he presented a yellow briefcase.

His proposals were met with criticism from all areas of the political spectrum, with Labour criticising him for trying to distance himself from the coalition after endorsing Osborne’s cuts and the Tories ignoring his proposals entirely.