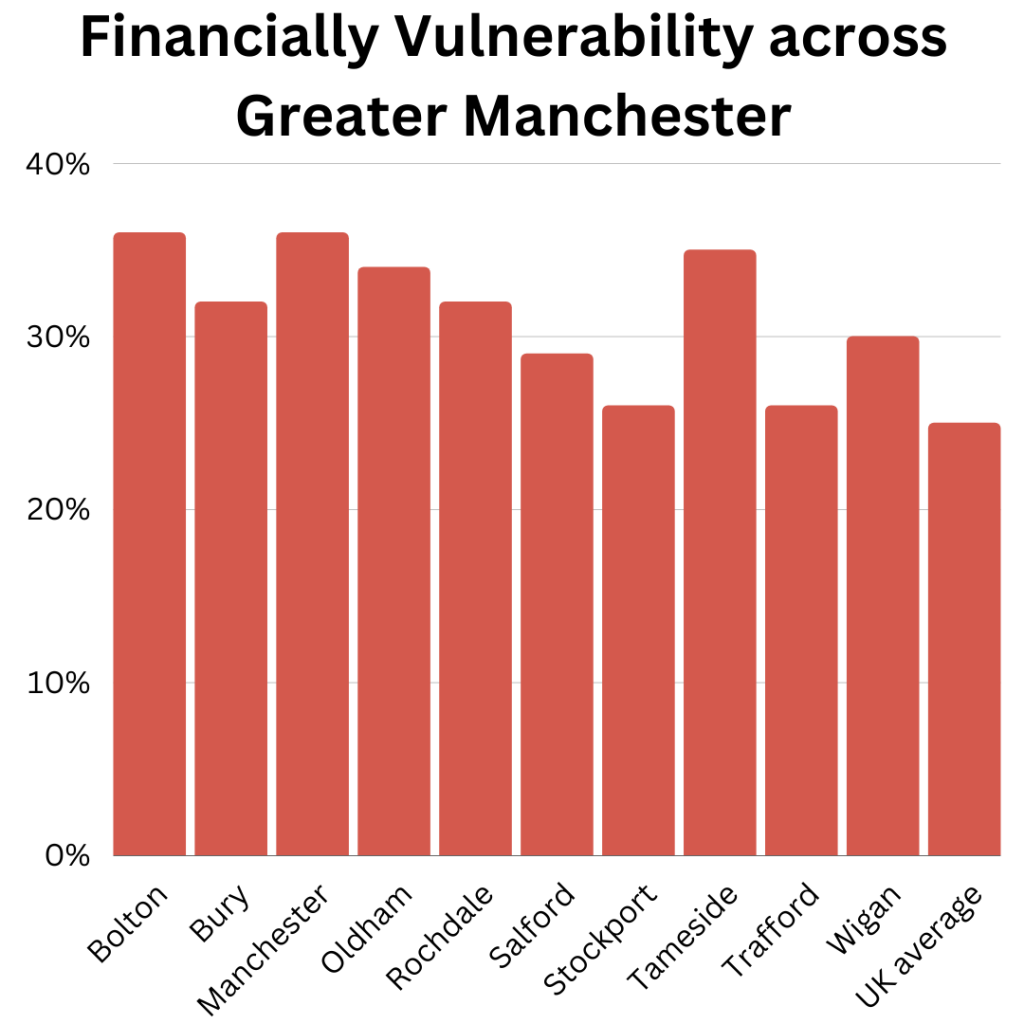

One in three Greater Manchester residents are considered to be financially vulnerable; with the blame being pinned on the cost of living crisis.

Manchester City Council Leader, Bev Craig, told the Greater Manchester Combined Authority (GMCA) that Greater Manchester is faring far worse than the national average in terms of financial security.

The national average of financial vulnerability is 25% – none of the GM boroughs are below this average.

Manchester and Bolton’s residents face the highest vulnerability at 36%, while Stockport and Trafford residents face the lowest at 26%.

Andy Burnham said: “We are on the brink now of what is going to be a really challenging winter.

“But in challenging times the Greater Manchester economy has continued to show resilience and growth.”

This is due to the growing presence of the cost of living crisis – seven in ten Greater Manchester residents believe the crisis has worsened in the past month.

Of those who are struggling to pay for gas and electricity, many are taking out loans to foot the bills.

By taking loans, the residents are becoming more vulnerable to debt – which is getting increasingly harder to pay back.

Two-thirds of Mancunians who are borrowing this money are struggling to manage their debt.

When presenting this report Bev Craig said: “We are seeing areas where there still is consistent and significant nervousness.”

Featured Image: GMCA webcast