Manchester has ranked seventh in new data showing the number of searches for more affordable car insurance relative to its population.

The city of Salford also came inside the top ten in the list of towns and cities across the UK seeking less expensive cover.

According to Google trends data, searches in the last 12 months for cheaper car insurance have exploded by 125%.

The prices have skyrocketed when policies come up for renewal, prompting many to search for alternatives to find a better rate.

The ONS has revealed motor insurance exceeded CPI inflation at an eye-watering 43.1% in the last 12 months to May 2023, despite general inflation being 8.7% in the same period.

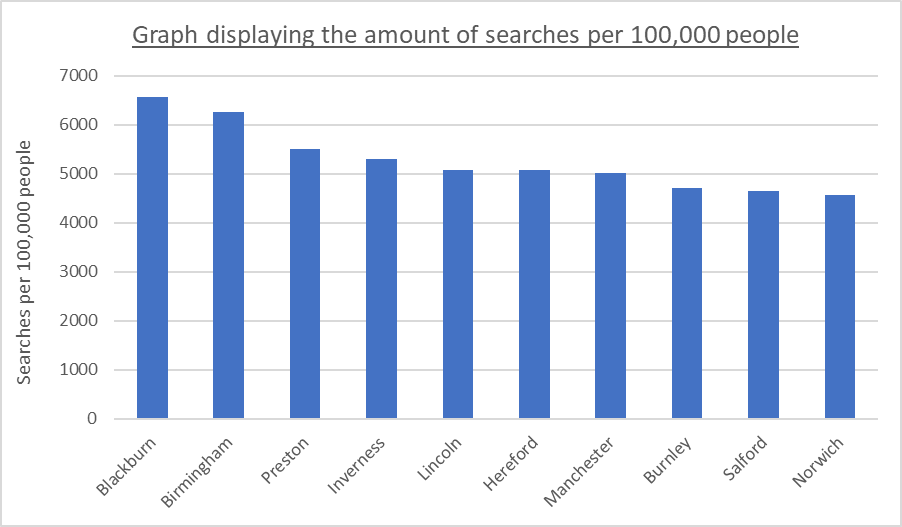

The company Zego analysed Google search data to establish which UK cities are making the most effort to find cheaper car insurance.

The research looked at Google searches from each city, using a list of 359 popular search terms people tend to use when looking to find more affordable car insurance.

Blackburn residents come out on top, with 6,564 searches per 100,000 people. Birmingham ranks second with Preston in third.

At the other end of the scale, Newport, Wakefield and Derry are the top three UK cities seemingly the least concerned about trying to get cheaper car insurance.

| City/Town | Total Searches | Population | Searches per 100k | Rank |

| Blackburn | 7743.33 | 117,963 | 6564.21 | 1 |

| Birmingham | 71620.00 | 1,142,494 | 6268.74 | 2 |

| Preston | 8114.17 | 147,617 | 5496.77 | 3 |

| Inverness | 2487.50 | 46,870 | 5307.23 | 4 |

| Lincoln | 5195.00 | 102,330 | 5076.71 | 5 |

| Hereford | 3194.17 | 63,024 | 5068.18 | 6 |

| Manchester | 27543.33 | 549,853 | 5009.22 | 7 |

| Burnley | 4453.33 | 94,721 | 4701.53 | 8 |

| Salford | 4825.83 | 103,886 | 4645.32 | 9 |

| Norwich | 6535.00 | 143,118 | 4566.16 | 10 |

Manchester placed seventh, with 5,009 searches per 100,000 people. This may be in part due to the increase in the number of cars in the city.

According to the Clean Cities Campaign, the number of privately owned cars increased by 31% in the last decade, from 117,388 in 2012 to 154,109 in 2022.

This rise in vehicles far outweighs the population growth of Manchester, which was just 6.9% between 2011 and 2021, explaining to some extent the high number of searches for cheaper car insurance in the city.

Salford also came inside the top ten, clocking 4,645 searches per 100,000 people.

Interestingly, following the ULEZ expansion in London, YouGov polled Brits on their perceptions of government policy towards drivers and non-drivers.

The poll found that Britons are split on the issue. A third think government policy favours non-drivers, while 25% think it favours drivers. A further 15% say it favours neither.

However, when focusing on those who drive at least once a week, there is a clearer result. Motorists feel that non-drivers are the main beneficiaries of government policy.

Do you think government policy tends to favour drivers or non drivers?

— YouGov (@YouGov) September 13, 2023

All Britons

Favours drivers: 25%

Favours non-drivers: 32%

Those who drive 5+ days a week

Drivers: 18%

Non-drivers: 41%

Those who don't drive

Drivers: 35%

Non-drivers: 13%https://t.co/x6efy88E4y pic.twitter.com/3Pj6na7BsQ

Amongst the most frequent drivers – those who drive on at least five days in a week – 41% say that the state tends to favour non-drivers, compared to just 18% who say it favours drivers.

Those who drive less frequently are slightly more likely to think policy favours drivers, but the percentage is still smaller than those who think non-drivers benefit more.

With both car insurance increases and a general feeling of unfavourable government policy for drivers, some current motorists may seek an alternative mode of transport in the near future.

Indeed, the inauguration of the Bee Network next year – Greater Manchester’s new integrated transport system composed of bus, tram, cycling and walking routes – could see many Mancunians ditching their vehicles very soon.

More information about the car insurance searches survey can be found here.