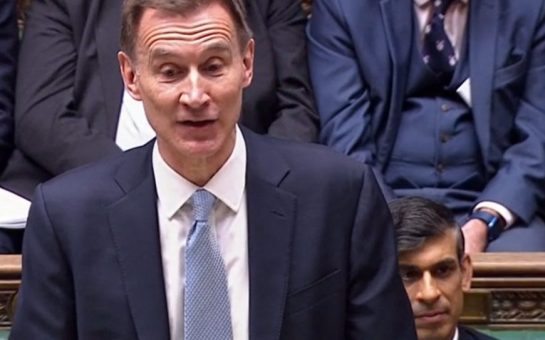

In his autumn budget statement, chancellor Jeremy Hunt has confirmed millions of households will see energy bills go up by hundreds of pounds per year from April.

He announced help for energy bills will be extended, but it will be less generous – despite a typical bill rising to £3000 a year.

There will be targeted support with the cost of living for pensioners and people on low incomes and disability benefits.

It comes after inflation reached another 40-year-high – 11.1%

Additional payments of £900 will be paid to those on “means-tested” benefits, £300 to pensioner households and £150 to people on disability benefits.

The National Living Wage for over-23s will be increased from £9.50 an hour to £10.42 from April – representing an annual pay rise of over £1600 for a full-time worker.

Pensions and benefits are also set to rise by 10.1% in line with September’s inflation rate – sticking to the government’s “triple lock” system on the state pension.

On personal tax, Hunt is set to lower the threshold when the highest earners start paying the top rate of tax – from £150,000 to £125,000.

In business tax news, the government will raise an extra £14bn by increasing the energy windfall tax from 25% to 35%.

This will mean an overall increase in energy companies’ tax from 65% to 75% on profits.

The chancellor also announced a 40% tax on profits of older renewable and nuclear energy.

The autumn budget, delayed from October 31, also announced extra NHS and social care funding, round two of the levelling up fund and new investment for schools.

- NHS healthcare budget will increase by £3.3bn

- Social care will receive a £2.8bn funding increase

- An extra £2.3bn per year will be invested into schools – there will be no VAT on independent school fees

- Tax as a percentage of GDP will increase by only 1% over the next five years

- Electric cars will no longer be exempt from Vehicle Excise Duty from April 2025

- Stamp duty cuts will remain in place until March 2025

- The defence budget will be maintained at 2% of GDP

- Aid spending will not return to its pre-cut amount of 0.7% of GDP – it will remain at 0.5%

- Plans are to proceed with a new nuclear plant a Sizewell C

- The government is aiming to reduce energy consumption from buildings and industry by 15% by 2030

- From 2025, there will be a further £6bn in funding to deliver the UK’s new efficiency ambition

- Round two of the levelling up fund will at least match the £1.7bn value of round one.

Image Credit: Number 10, Flickr