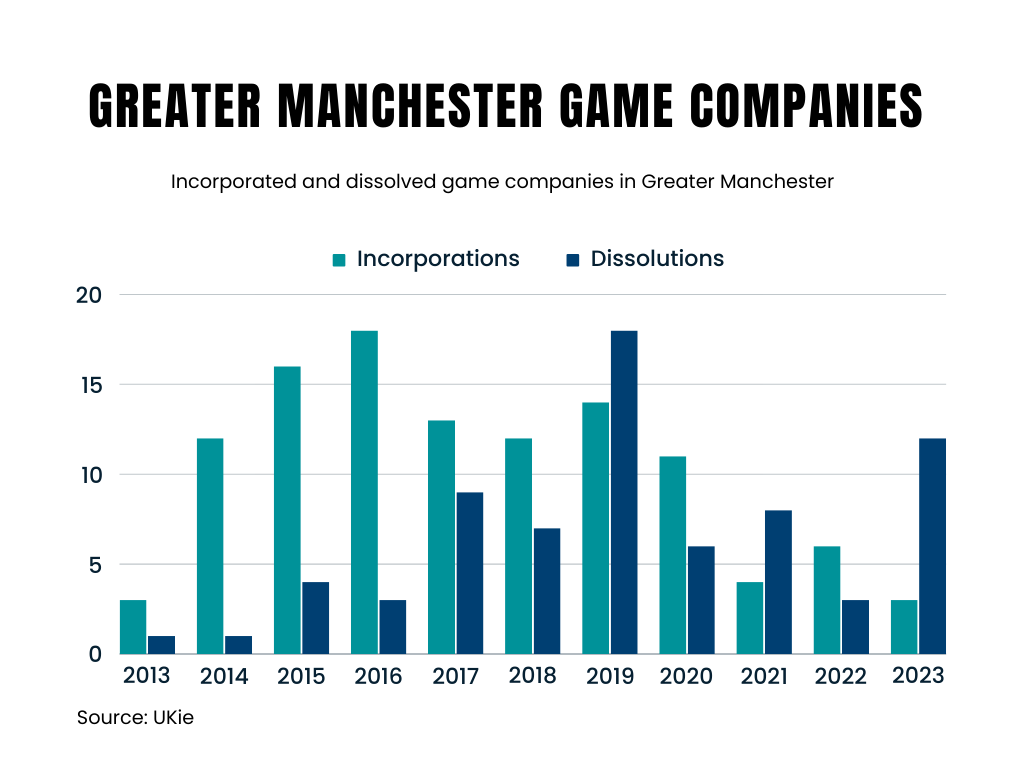

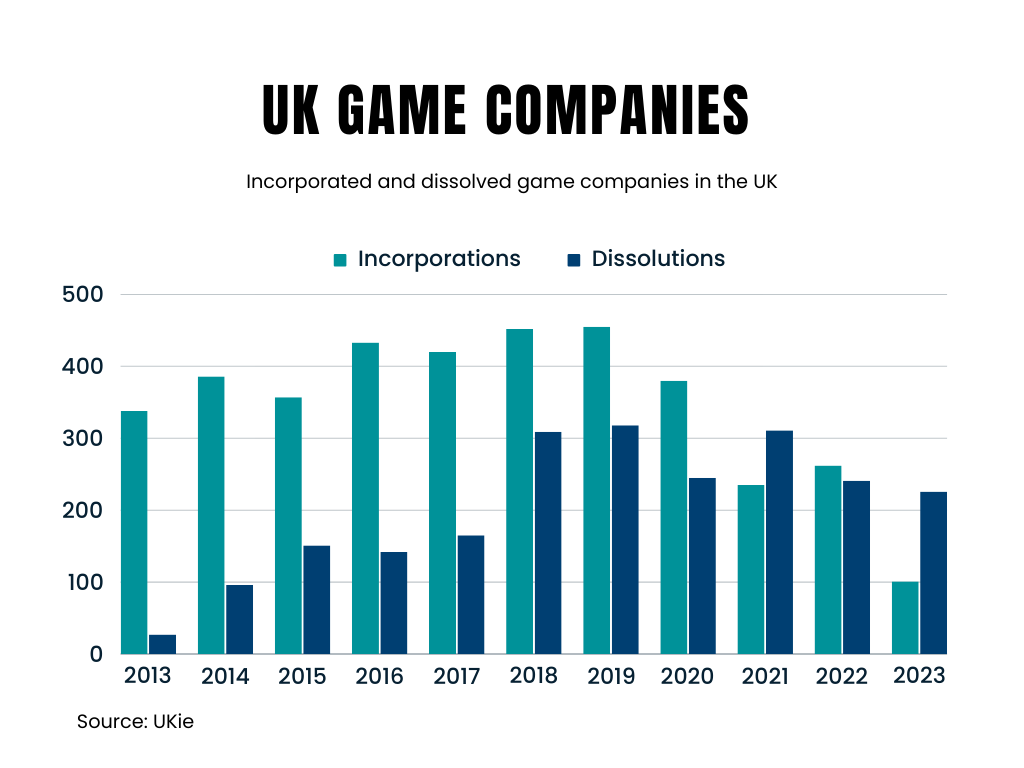

The number of new gaming studios in Greater Manchester was 78% lower in 2023 than in 2019 – despite the significant growth of the game industry.

The data, from video game trade body UKie, shows that the number of newly incorporated game companies has decreased yearly since 2019. As of January 2024, the number in Greater Manchester declined by 78% compared to 2019, with exactly the same figure for the entire UK.

This unexpected trend has happened while the industry is experiencing significant growth. The United Kingdom is Europe’s largest video game market and is among the world’s top 10 gaming industries. According to the trade body Tiga, the country’s gaming sector grew by 11.4% between December 2021 and April 2023, with the total industry workforce reaching 25,026.

With more than 70 active game companies as of January 2024, Greater Manchester has played a significant role in the UK’s game industry – with UKie data putting Manchester as the second-leading video game production city in the UK after London.

To understand what is going on, it is necessary to have a look at the past. Before 2019, the number of newly incorporated companies has been more or less at growth and the overall trend has been positive.

The COVID-19 pandemic has had a significant positive impact on the gaming industry to the extent that the value of the UK video game market reached a record of £7.16 billion in 2021, with a significant increase in investments in video games, according to the UKie 2021 report. With people staying at home and seeking new forms of entertainment, the gaming industry experienced sudden growth, leading many to consider entering the world of game development.

Also, game development tools and engines have become more accessible and cheaper in recent years, providing an opportunity for anyone to start developing their ideas for games.

Pete Bottomley, co-founder and studio head at White Paper Games, a video game company based in Salford, said: “Around 2012 to 2016, a big wave of titles were being released by the independent games industry.

“People saw small teams making games that they really resonated with. So, many got excited to make games. Those who were not graduates or without any industry experience, or those who were working in large companies, all decided to start their own studios.”

Mr Bottomley, an associate lecturer on game design courses at the University of Central Lancashire, believes that the number of new game studios has decreased in recent years, especially with university graduates.

He said: “Those game developers with industry experience are more backed by funding from publishers and investors. But graduates or those small teams who are at the beginning of their way in game development are less likely to get funds for their projects. This might be a reason for a reduction in the number of new studios.”

The UKie data also shows that the number of dissolved companies in 2023 is four times as high as last year’s figure. Looking more closely at the dissolved companies in Greater Manchester, the majority of them are small game startups that had survived only one to three years in the market.

Despite the ongoing growth in the UK’s game industry, the support provided by the government, and the more accessible game-developing tools and training in recent years, the data indicates that these are not all the requirements to survive in the game industry.

Government-provided funds and tax relief can certainly alleviate financial burdens for small game companies, but they might not eliminate financial challenges. Tax relief, for example, often comes into play after the development process or when the company starts generating profits. So, until then, the company may face challenges.

Also, the highly competitive gaming market makes it hard for small startups to stand out among established competitors or break into a market flooded with tens of similar games.

Some game developers who seek to establish a company are recent graduates of the field and are mainly focused on the technical side of game development. In these cases, a lack of a clear business plan or a marketing strategy, and therefore, difficulties in generating revenue from the games, can interrupt a company's growth and lead to dissolution.

Mr Bottomley believes since 2022, as a kind of post-COVID effect, funding in the game industry has become more restricted, and investors are more willing to support teams with a proven track record and experience in the field.

He said: "If a small team relies on funding to back their studio and that funding goes away, they may struggle to operate as a game studio anymore if they haven't thought about establishing multiple sources of income.

"Making games is incredibly tough. It can be very taxing and time-consuming, and not everyone does it for financial rewards. If you need some kind of financial reward or some kind of income to maintain a certain lifestyle or family, or you have financial commitments, games can be a tough space for that.

"I've seen quite a few people move outside the games into other industries. Because the pay, the hours, and the standard of living might be better overall. Or it might be that they just got tired of operating this way."

The recent decline in new UK game studios is a multifaceted issue. While positive growth continues in the broader gaming industry, emerging developers face many challenges. Restricted investments, market competition, and post-pandemic side effects on funding have hit inexperienced teams hard in particular.

The UK government's encouragement for the game business has boosted the industry, yet more may need to be done to support new studios. Addressing the complex factors discouraging startups will help stabilise the industry. If new game developers keep shutting down at scale, it risks jeopardising the health, diversity and innovation capacities across the whole game industry.

Feature image courtesy of Florian Olivo.