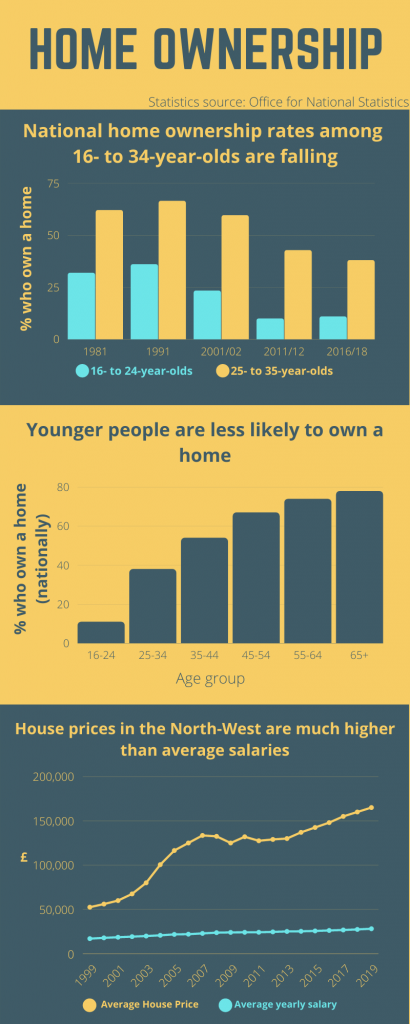

House prices have risen at more than double the rate of average salaries over the past decade, and younger people are now far less likely to own a home.

Property prices across the North West have risen by 214% since 1999, while yearly salaries have only risen by 66%.

Younger people are now struggling to find their way onto the housing ladder, with less than 40% of 25- to 34-year-olds owning their own home.

Rachel Bassett, 29, from Stockport, said: “Personally I’ve found it difficult as a person buying on my own as I save a lot for a deposit, but you have to have nearly five times your salary to get a mortgage.

“I’ve been working a lot to get up to a certain salary level for a decent house but it’s an ever-extending goal post which is a nightmare.

“Covid-19 made it worse as the stamp duty made the prices increase, but that only benefits people who already have houses and not first-time buyers.

“I’m nervous that I’m going to be constantly chasing the rising house prices until I find a partner to buy with.”

Data from the Office for National Statistics (ONS) shows the average price of a property in the North-West is £165,000, with an average yearly salary of £28,137.

The average price of a property in Manchester is £179,900, a 6% rise over last year’s prices, according to real estate company Zoopla.

ONS data for 2016 to 2018 showed that home ownership rates are much lower in younger age groups, with 38% of 25- to 34-year-olds owning a house, compared to 78% of over-65s.

Experts say one of the barriers to getting on the housing ladder is securing a deposit for a mortgage.

Katie Watts, consumer expert at MoneySavingExpert.com, said a 15% deposit is needed to secure a mortgage, as 10% mortgages are hard to come by.

A 15% deposit on an average property in the Manchester would amount to £26,850, nearly an entire year’s average salary in the region.

Ms Watts said: “First, consider if buying a house is really right for you.

“If it’s a case of continuing to save up, or over-stretching and having your first home repossessed – it’s a no-brainer.

“Remember, renting isn’t a dirty word.”