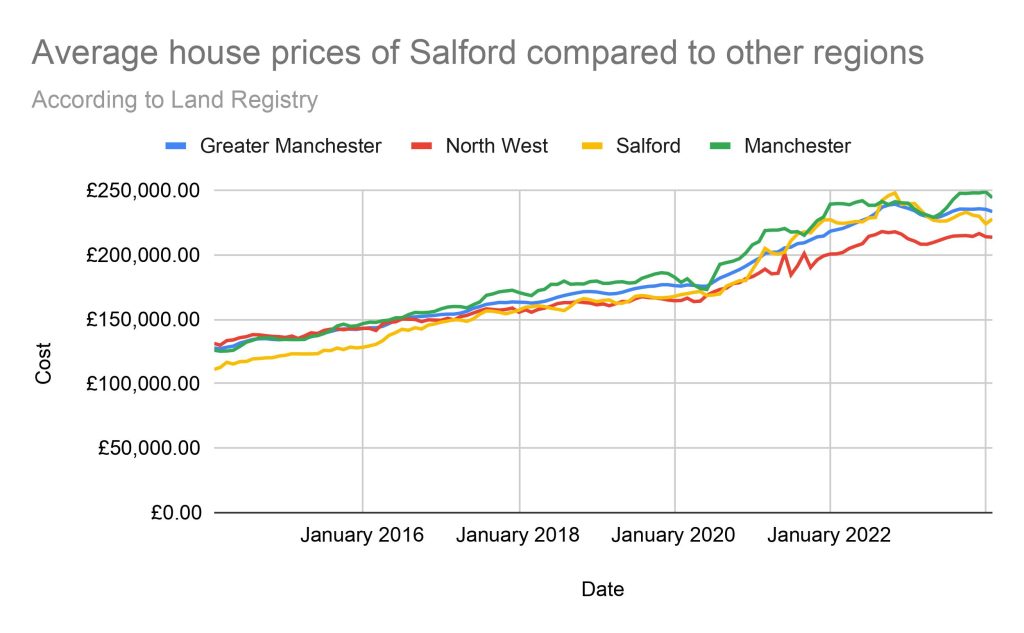

The price of an average Salford house has more than doubled in the past decade, rising by 105%, according to the data from government’s Land Registry service.

Prices in February 2024 show that the average cost of property in Salford is £228,048 – compared to 10 years earlier when it was £111,253.

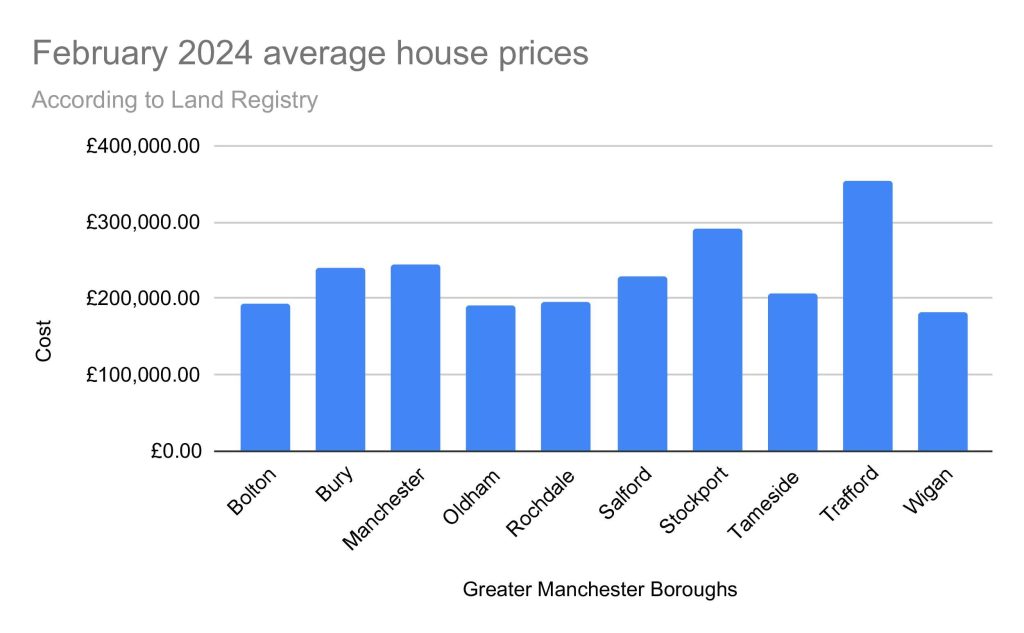

Out of the 10 Greater Manchester boroughs, Trafford, Stockport and the City of Manchester are the most expensive with Wigan, Oldham and Bolton being the cheapest.

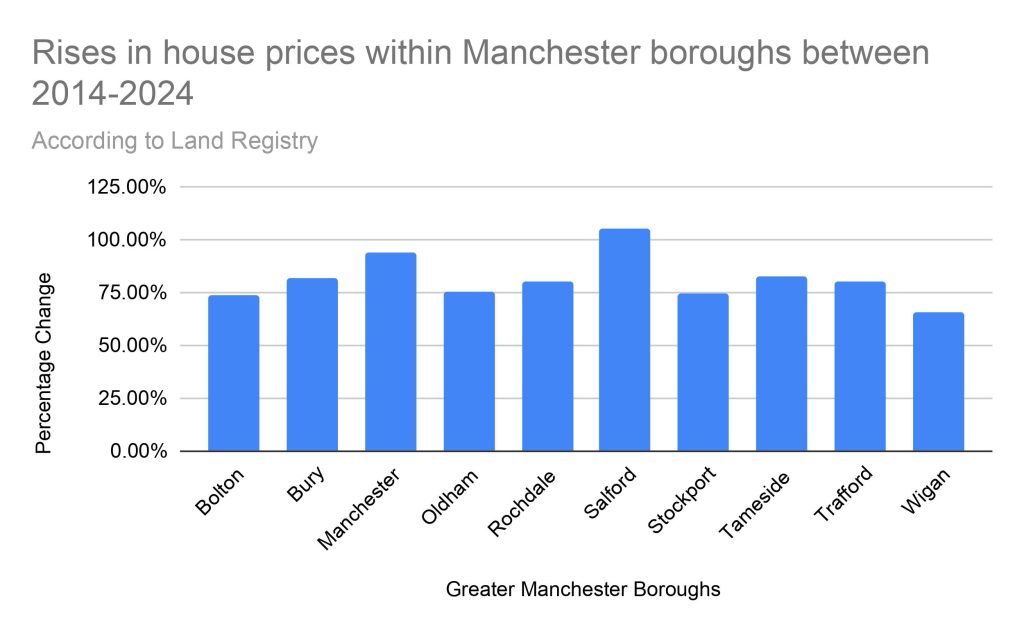

The house prices in all boroughs in Greater Manchester have risen by at least 65% with Salford, Manchester and Tameside having the greatest jump in prices.

The percentage change in Salford house prices is 11.03% greater than that of the second most increased borough, Manchester, where prices rose by 93.95%.

Although Salford doesn’t have the most expensive housing, the rise in house prices is the greatest, compared to Manchester, Greater Manchester and the North West.

Lawrence Copeland, the director of a Manchester estate agents which bares his name, said: “Closeness to the city centre, its communication and transport facilities such as Metrolink drives up prices. Wherever you are in Salford you are two to three miles from the city centre.

“As Salford is the closest borough to the centre core, it may have benefited the most.”

Copeland also alluded to house prices rising more than apartments due to the limited supply of them in the urban and suburban areas.

When specifically looking at the M5 postcode, data produced by Land Registry shows that prices of detached houses increased by 104.75% in the last decade. In comparison, flat prices rose by 80.55% within that same time frame.

Meanwhile semi-detached houses between 2014 and 2024 prices more than doubled, and there was a 91.84% elevation in cost for terraced properties.

The M5 postcode incorporates areas such as Ordsall, Seedley, Weaste and the University of Salford.

Marcella Hickson, 56, works as an IT Service Business Analyst. She has lived in Eccles, Salford, since 2012 after moving to England from Arizona, USA. Her three-bedroom house was valued at £120,000 over a decade ago whereas today’s market value is £260,000.

Hickson said: “The convenience of the Metrolink and accessing MediaCityUK meant prices went up exponentially and also the time of houses being on the market became shorter.

“Nowadays in Monton, there is a lot more single, professional, no-children type of demographic and this is emulated by the highstreet evolving from your classic butchers and bakers to now wine bars and restaurants to accommodate the new population.

“Even in the street, before you used to know the neighbours, now it’s more inclusive rather than community driven.

“The increase is surprising as income hasn’t gone up in line with inflation – taking into consideration the MediaCityUK influence but also the cost of living crisis.”

According to Rightmove another factor that causes house prices to increase is a shortage of supply. In popular areas, “Only a very slight increase in demand can cause a proportionally significant rise in house prices”.

And according to conveyancing solicitors Homeward Legal, the reasons for this include supply and demand in the property market, credit availability and the geographic and town planning of an area.

The rise in house prices has been seen in not only Salford, but the surrounding areas too. Greater Manchester has risen by 82.9%, the North West by 62.8% and England by 57.2%.

House prices have affected everyone from first time buyers, long time home owners and those who are hoping to buy in certain areas of Greater Manchester.

The amount of income needed to get on the housing market has also risen due to the increased property prices.

Emily Potts, 23, a Production Assistant on a Netflix drama and first-time buyer, said:

“From moving to Kearsley in the Bolton borough, my partner and I didn’t want to move too far from our parents as I was living with them in Ainsworth previously.

“We can get more for our money in comparison to South Manchester and Bury that we considered, but if we did move there we couldn’t renovate.

“As a first-time buyer, I never thought about bills, only the mortgage and renovation costs – builders are so much more than I originally thought.”

It’s not just first-time buyers but how the city has evolved with the density of people and infrastructure in the centre of Manchester.

Bev Craig, Leader of Manchester City Council and Labour politician said: “The growth of our city has been unprecedented and our population over the last decade has grown now to over 600,000 in the city.

“National government made it harder for councils to build council and social housing between 2011 to 2017 until change in legislation and the freezing of local housing allowance from 2011 to this year.”

Thinking about the future of housing and ways to build new homes in the city of Manchester, Craig said:

“Moving forward local interventions includes a housing strategy building 36,000 new homes between now and 2032 in which 10,000 are social council houses to ensure they are affordable low carbon homes.

“We can’t do this alone and need national government interventions that show the housing crisis that’s evolved in the last decade, that supply of housing is not being met.

“The city of Manchester could do so much more if the government hadn’t capped housing benefits and put restrictions in local authorities to stop them building council houses.”

This was backed by Greater Manchester Mayor Andy Burnham, who said: “It’s time for Greater Manchester to focus more on housing. Housing is fundamental to everything, you can’t have good health or a good life without good housing.”

Burnham said that going forward after the local elections on 2 May, housing will be a big focus.

Wigan has the least change in housing prices with a 65% increase and is now the cheapest borough to buy in with some residents there still can’t buy but still really want to buy.

Dec Morris, 32, a complaints handler at Currys who lives in the Wigan borough, said: “I’ve been scouting the area recently after a house on my street sold, but I am only renting at the moment. It’s given me incentive to buy.”

Main image by Ollie Dennett