Bolton Wanderers’ announcement earlier this week that payday loan company QuickQuid will become their new shirt sponsor sparked both outrage and debate.

Bolton West Labour MP Julie Hilling claimed it was a sad day for the club and has urged Wanderers to reconsider the two-year deal.

The decision has seen a backlash from the fans too, with a petition calling on the Championship club to reverse the decision attracting more than 1,900 signatures by yesterday lunchtime.

With the company charging interest rates of 1,734% on short-term loans, around 60 people protested last night outside Bolton Town Hall.

They are not alone though, with fellow lenders Wonga charging an astronomical 4,214% on their short-term loans will sponsor Newcastle United next season.

MM took to the streets of Manchester to find out what people think of payday loan companies and their practises, we asked:

Do you think payday lenders are immoral?

| Option | Results |

| Yes | 73% |

| No | 27% |

Julie Large, a 53-year-old careers advisor in the city centre, said: “The interest rates are so high that people cannot afford to pay it back.”

Charlie Veys, a 22-year-old student who lives in Withington, said: “They are a bit extortionate with their interest rates.”

James Rutter, a 29-year-old teacher from Ashton-under-Lyne, said: “They manage the weaker end of society. They know they can make money off it and they do not care as long as they get the money.”

A 45-year-old care worker from Oldham, who did not wish to be named, said: “They absolutely are. Even in my darkest days, I have not considered them.”

William Turner, a 24-year-old engineer from Liverpool, said: “They lend out too easy and the interest rates are so high.”

His colleague Jamie Watkinson, 21, also an engineer from Liverpool, said: “They advertise it too easily. You can have it in your bank in 15 minutes, even if you have not got the money to pay it back.”

Zsuzsanna Farago, a 32-year-old healthcare worker who lives in Preston, said: “If there are high interest rates, it is not really fair.”

Omar Farooq, a 31-year-old computer software developer from Bury, said: “I think they do take advantage but people are desperate. They know they are going to be charged high interest rates and people need to know what they are getting themselves into.”

Bill Chatwin, a pensioner from Cheadle Hulme, said: “If people are stupid enough to use it without checking, then it is their fault.”

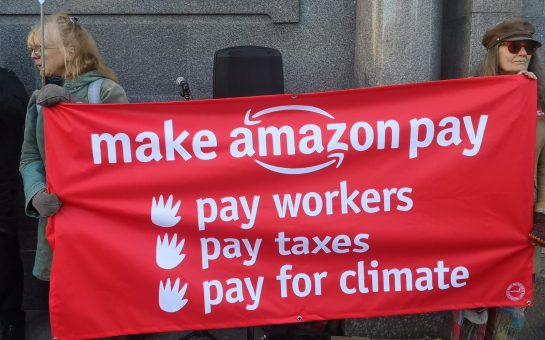

Picture courtesy of WikiCommons, with thanks.

For more on this story and many others, follow Mancunian Matters on Twitter and Facebook.